Company Formation Costs Accounting Treatment

Your costs may include research legal. Hi EverybodyCompany set up fees are non tax deductable and are capital costs.

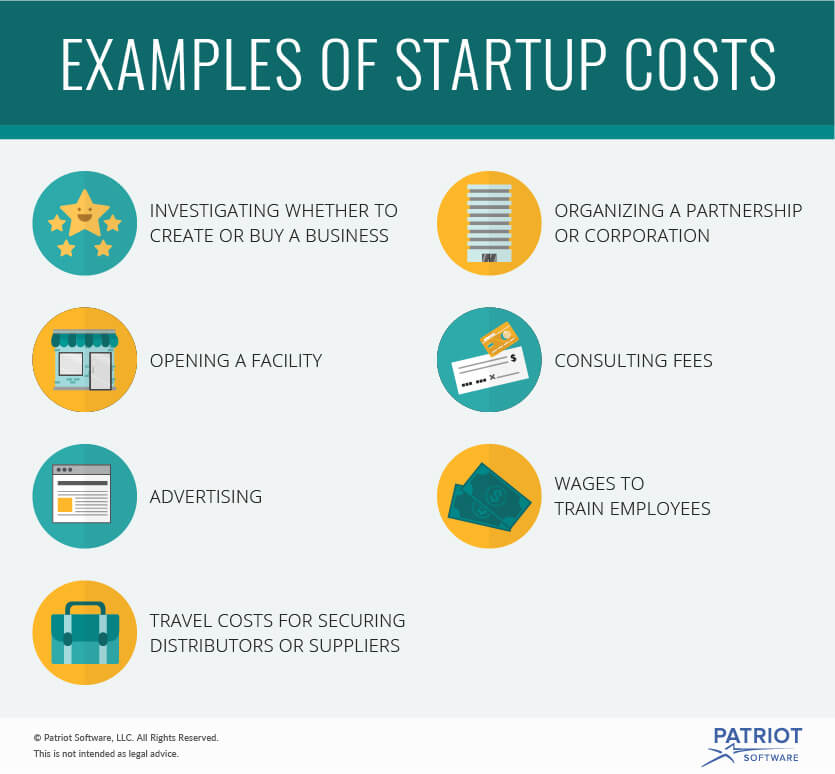

Accounting For Startup Costs How To Track Your Expenses

However there are no future economic benefits to be gained from.

. Certain start-up expenses including costs associated with raising capital that would otherwise be deductible over five years are immediately deductible from July 1 2015 where they are. Accounting treatment of establishment expenses. Setting up or ceasing a business.

It should be noted. If you spent less than 50000 total on your business start-up costs you can deduct 5000 of those costs immediately in the year that your business starts operating. How should a company account for the legal costs of formation.

Establishment expenses are all necessary to establish an establishment a company or a factory until it acquires a legal entity. Should the accounting treatment be the same as that for underwriting and other share issue costs. Special rules apply to claiming deductions for the following capital expenses some of which involve depreciating assets.

We offer services to help keep your LLC compliant like federal tax IDEIN licenses. Offering Costs amortize to expense over 12 months on a straight line basis. C Cost of printing of the memorandum and articles of.

The expenses incurred in setting up a company is to be treated as Preliminary Expenses and amortized over a period of5 years. The question I think is about the. Hi Right I know Formation costs are not an allowable expense when calculating Sch D1 Trading profits for Corporation Tax.

Legal costs of formation were traditionally treated as an asset and then systematically amortised over an arbitrary period. If a portion of the expense remains to be amortized at the end of the period the balance is commonly reflected. For costs paid or incurred after September 8 2008 the business can deduct a limited amount of start-up.

I have queries about company set up feesCan company s. The debit entry records the incorporation expenses which are the costs of setting up the business. Ad Well do the legwork so you can set aside more time and money for your business.

Ad Accounting Made Easier With QuickBooks by Intuit. Must only capitalize half of this cost since it was only available for that time. The incorporation expenses have been paid by the owner from personal.

Company Formation expenses. On top of that the borrowing costs will amount to 2 million 20 million x 10 interest rate. 9 years agoSee more.

Startup costs for micro-businesses and home-based businesses typically run under 5000 although thats not a hard and fast rule. B Fees for registration of the company. Generally the business can recover costs for assets through depreciation deductions.

Sign Up on the Official Site. A Legal cost in drafting the memorandum and articles of association.

10 Finance Resume In 2022 Finance Jobs Finance Project Manager Resume

How To Estimate Realistic Business Startup Costs 2022 Guide Bplans

How To Estimate Realistic Business Startup Costs 2022 Guide Bplans

How To Estimate Realistic Business Startup Costs 2022 Guide Bplans

How To Estimate Realistic Business Startup Costs 2022 Guide Bplans

Cost Management Explained In 4 Steps

0 Response to "Company Formation Costs Accounting Treatment"

Post a Comment